eToro Review 2024

Regulated and trusted. Tested via live trading.

57,250 people chose this broker

Not available in Nigeria; see best alternatives

Why choose eToro

eToro stands out as an excellent choice for beginners, thanks to its user-friendly app and competitive fees. I've found their service ideal for investing in stocks and ETFs. What sets eToro apart is its superior copy-trading feature, which outperforms similar services from other brokers. However, it may not be the best fit for short-term traders, as its CFD fees aren't as competitive.

Disclaimer: Cryptocurrency trading is not available in the following countries: Denmark, Estonia, Finland, Greece, Liechtenstein, Lithuania, Luxembourg, Norway, Sweden, Poland, Slovakia and Slovenia. CFD trading is not available in Spain.

Pros

Free stock and ETF trading

Seamless account opening

Social trading

Cons

$5 withdrawal fee

Only USD as base currency

Customer support should be improved

eToro

4.8

/5

Overall score

Minimum deposit

$50

Stock fee

Low

Index CFD fee

Average

Withdrawal fee

$5

Account opening

1 day

51% of retail CFD accounts lose money

Fees

Score: 4/5

eToro offers free stock and ETF trading in most countries, while forex fees are low and CFD fees are average. On the negative side, there are non-trading fees, such as a $5 withdrawal fee.

Pros

Low trading fees

Low forex fees

Free stock and ETF trading

Cons

Inactivity fee

$5 withdrawal fee

We compared eToro's fees with two similar brokers we selected, Trading 212 and XTB. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of eToro alternatives.

Commission-free real stock and ETFs

It’s extremely great as eToro has commission-free US stock trading.

This applies to most countries, but for clients from Australia, Denmark, Finland, the Netherlands, Norway, Spain, and Sweden, a commission fee of $1-2 per trade is charged for stocks. However, ETFs are commission-free regardless of your country. Note that when you're buying a real stock, not a CFD product, you cannot use leverage.

Trades that involve stocks not traded in USD (like UK or European stocks) will be converted to USD at the actual market prices by eToro, without taking any commission or markup. What's more, eToro will also absorb any tax duty that might be due if you trade on the UK market.

Low FX fees

All fees are built into the spread, so there is no separate commission charged. For example, the EUR/USD spread is 1.0.

Average index CFD fees

All index CFD fees are built into the spread. The spread for S&P 500 index CFDs is 0.8.

Low inactivity fee, low withdrawal fee

eToro charges $10 per month after one year of inactivity, but simply logging into your account counts as an activity. There is also a $5 withdrawal fee.

Other commissions and fees

Low stock CFD fees: the commission for stock CFD trading is the following - 0.15% spread per side.

Low options fees: trading German index options is charged as follows - Not available.

High spot crypto fees: at eToro, crypto trading costs 1% of trade value.

Low margin rates: the USD annual margin rate is 8.3%.

Check out this article for a detailed analysis of all the fees, commissions and other charges levied by eToro.

Safety

eToro is a legit brokerage. It is regulated by top-tier financial authorities like the FCA, the SEC, ASIC and CySEC. However, it is not listed on any stock exchange and does not have a bank parent.

Pros

Majority of clients belong to a top-tier financial authority

Negative balance protection

Financial information is publicly available

Cons

Does not hold a banking license

Not listed on stock exchange

Is eToro regulated?

Yes, it is regulated by the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the US Securities and Exchange Commission (SEC), and the Australian Securities and Investment Commission (ASIC).

eToro USA LLC is also a registered Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) in the United States.

Is eToro safe?

To be certain that a brokerage is safe, we highly advise that you check two facts:

-

how you are protected if something goes wrong

-

the background of the broker.

How you are protected

eToro operates several legal entities and serves customers based on their residency. This matters because the entity you belong to defines the amount of investor protection you get.

-

Citizens of the United Kingdom can open an account at eToro (UK) Limited and thus they will be protected by the FCA. If eToro becomes insolvent, eToro UK clients can expect to be compensated by the maximum amount of £85,000 guaranteed by the Financial Services Compensation Scheme (FSCS).

-

US clients will open their account at eToro USA LLC, which enjoys SEC and FINRA protection and is a member if the SIPC investor protection program. This offers investment protection up to $500,000 (including $250,000 for cash).

-

Australian clients are served by eToro AUS Capital Ltd, ABN 66 612 791 803 AFSL 491139, which is regulated by ASIC, the Australian financial authority. ASIC however does not provide any obligatory investor protection for a pre-set amount.

-

Other investors will have their live trading accounts with eToro (Europe) Limited, which is regulated by the Cypriot watchdog, CySEC. The amount of investment protection coverage at eToro Europe is a maximum of €20,000. This threshold is set by the Cypriot Investors Compensation Fund.

eToro also offers private insurance to certain clients of some entities. This is a €/AUD 1 million insurance for cash, securities and CFDs. It is provided by Lloyd's and applies in the event of eToro's insolvency. This is a great addition as not all brokers provide another layer of protection above the regulatory one. However, it is only available for Platinum + and Diamond Club customers of eToro (Europe) Ltd and eToro AUS Capital Limited. Plus, of course, it could be withdrawn by eToro at any time.

Here is a handy summary table for easy comparison:

eToro investor protection

Country of clients | Protection amount | Regulator | Legal entity |

|---|---|---|---|

United Kingdom | £85,000 | Financial Conduct Authority (FCA) | eToro (UK) Ltd. |

Australia | $1,000,000 | Australian Securities and Investments Commission (ASIC) | eToro AUS Capital Ltd. |

United States | $500,000 ($250,000 cash limit) | Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) | eToro USA LLC |

Other countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | eToro (Europe) Ltd. |

There is no investor protection for cryptos.

eToro also provides negative balance protection for CFD trading, but only for retail clients from the European Union and Australia. Professional clients are not covered with any negative balance protection.

Our brokerage experts put together a comprehensive guide on the safety profile of eToro.

Background

eToro was established in 2007. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. This means that it has already survived one crisis, which is a good sign.

eToro is a privately-owned fintech company, with owners including venture capital funds like Commerz Ventures Gmbh, the VC arm of Commerzbank, as well as Israeli, US and Chinese investors. eToro is led by Yoni Assia, its well-known founder and CEO.

In addition, financial information on the company is publicly available.

Deposit and withdrawal

Score: 4.1/5

Depositing money is easy, with a lot of available options. On the negative side, there is a $5 withdrawal fee. Also, as only USD accounts are available, you may pay a high conversion fee if you deposit or withdraw in another currency, like EUR or GBP.

Pros

Credit/debit card available (in US & UK only debit card)

User-friendly

Cons

Only one account base currency

$5 withdrawal fee

Conversion fee for non-USD deposits

Account base currencies

At eToro, the only available base currency is USD.

This means that funds in other currencies might need to be converted by eToro to USD.

For example, if you deposit EUR by bank transfer, a 50 pip conversion fee will be applied at funding (which is around 0.46% of the deposit amount) and the same fee will also be charged when you withdraw EUR by bank transfer. For other methods, like credit cards, a higher fee applies for some currencies

Alternatively, you can deposit in USD, for example by using your bank card. In that case, your bank will make the conversion at its own exchange rate.

If you have a personal bank account in a currency other than USD, then you will be charged a conversion fee.

A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. These usually offer bank accounts in several currencies with great currency exchange rates, as well as free or cheap international bank transfers. Opening an account only takes a few minutes on your phone

Deposit fees and options

eToro charges no deposit fees.

There are a lot of deposit options available, including bank transfer, bank card, and electronic wallets.

The available deposit methods might differ based on country of residence.

Here's all you need to know about depositing money at eToro and key info on minimum deposit requirements.

A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

eToro supports the following electronic wallets:

For some countries, eToro may require the first deposit to be made with credit/debit card or bank transfer and allow only subsequent deposits to be made with electronic wallets.

There is no upper limit on how much you can deposit via bank transfers. In comparison, while credit/debit card and electronic wallet deposits are instant, there are per transaction limits: $40,000 in the case of credit/debit cards, and either $10,000 or $30,000 (Klarna) in the case of electronic wallets.

Also note that although eToro charges no deposit fees, they apply currency conversion fees that could run quite high. As an example, the conversion fee may be as much as 1.4% for depositing EUR by card. Keep in mind that a 50 pip charge is not the same percentage of your deposit in AUD to USD conversion as in EUR to USD conversion. We collected some examples in the table below to show conversion fees with some currencies, adding an estimation of the percentage charge as well.

eToro's deposit currency conversion fees

Methods | USD | EUR | GBP | AUD |

|---|---|---|---|---|

Bank transfer | none | 50 pips, approx. 0.46% of the deposit amount | 50 pips, approx. 0.40% of the deposit amount | 50 pips, approx. 0.77% of the deposit amount |

Other methods | none, your bank will charge for conversion if your card is not in USD | 150 pips, approx. 1.40% of the deposit amount | 50 pips, approx. 0.40% of the deposit amount | 100 pips, approx. 1.56% of the deposit amount |

eToro review - Deposit and withdrawal - Deposit

eToro withdrawal fees and options

eToro has a $5 withdrawal fee, which is high when compared to other CFD brokers. In addition, eToro has a $30 minimum amount limit on withdrawals.

Withdrawal options are the same as the funding options: you can withdraw money using bank transfer, credit/debit card or electronic wallets.

Read this guide with all key info on available withdrawal methods and related fees.

You can only withdraw money to accounts in your name.

How do you withdraw money from eToro?

-

Click on the 'Withdraw Funds' tab in the left-hand menu.

-

Enter the amount you wish to withdraw (in USD).

-

Complete the electronic withdrawal form as required.

-

Click 'Submit'.

eToro review - Deposit and withdrawal - Withdrawal

Account opening

Score: 5/5

Account opening at eToro is seamless and very fast, and the minimum deposit is relatively low for most countries.

Pros

Fast

Fully digital

Low minimum deposit

Cons

None

What is the minimum deposit at eToro?

The required eToro minimum deposit is $50.

Note however that the minimum amount for a bank transfer is $500. Also, some countries have different minimum deposit requirements:

Deposit minimums

After your first-time deposit, subsequent deposits also have a minimum of $50 for most countries. The exceptions are the US and UK, where later deposits have a $10 minimum.

Your first-time deposit amount at eToro depends on your residency and can range from $50 to $10,000 (see the table below). For most users, a $50 deposit minimum applies.

Minimum deposit amount at eToro by residency

Users residing in: | Minimum deposit amount: |

|---|---|

Australia, Ireland, Italy, Mexico, South Africa, United Kingdom, Germany | $100 |

European Union countries (excluding listed above), UAE, India, Thailand | $500 |

Canada, Japan, Singapore, United States | $1,000 |

Saudi Arabia, Qatar, Kuwait, New Zealand | $2,000 |

All other eligible countries | $2,000 |

Account types

eToro offers two simple account types: there is a live account, as well as a demo (or virtual) account, where you can test the platform with play money.

For UK clients, tax-advantaged ISA accounts are also available as of March 2023, through a partnerhsip with Moneyfarm, a European digital wealth management firm.

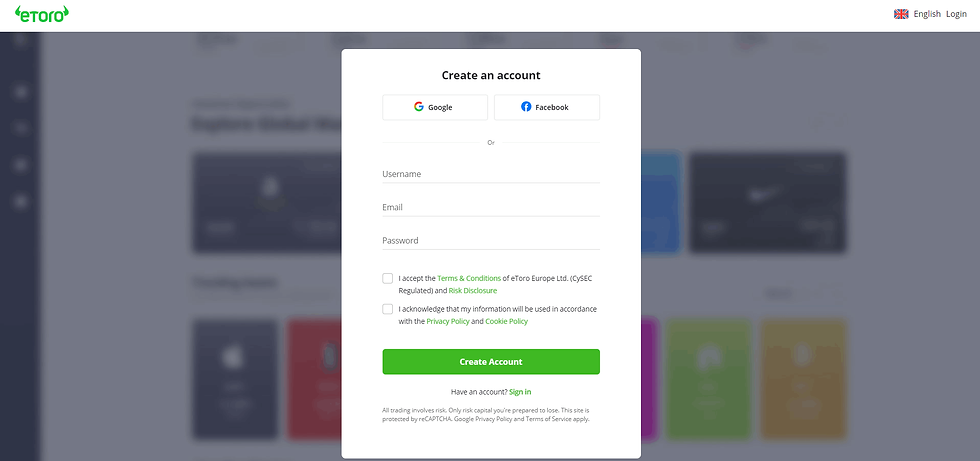

How to open your account

The account opening process is hassle-free and fully digital. It is fast too, as we were able to open an account within one day.

You have to start by registering with your email account or with your Facebook or Google account. And that's basically it – you can immediately access the trading platform and start to trade with a $100,000 demo account.

If you want to go further and fund it with real money, you have to verify your identity and residency by uploading the required documents:

-

Proof of identity: a copy of your passport or personal ID.

-

Proof of residency: a copy of a utility bill or bank statement.

eToro review - Deposit and withdrawal - Withdrawal

Web trading platform

Score: 4.4/5

eToro offers a user-friendly and well-designed web trading platform, where social trading is also available. On the other hand, the platform's customizability is limited.

Pros

User-friendly

Clear fee report

Two-step (safer) login

Cons

Limited customizability (for charts, workspace)

eToro's platform is intuitive and easy to use even for beginners.

The web trading platform is available in several languages.

Look and feel

The web trading platform has a clean design and great functions. The menus and buttons are where you expect them to be.

It is hard to customize though, as the panels are fixed. One exception is the watchlist, which is easy to configure.

eToro review - Web trading platform

Login and security

eToro provides a safer, two-step login.

Search functions

The search functions are good.

Type in a company or product name and you can see the results. You can search easily using tickers, too.

eToro review - Web trading platform - Search

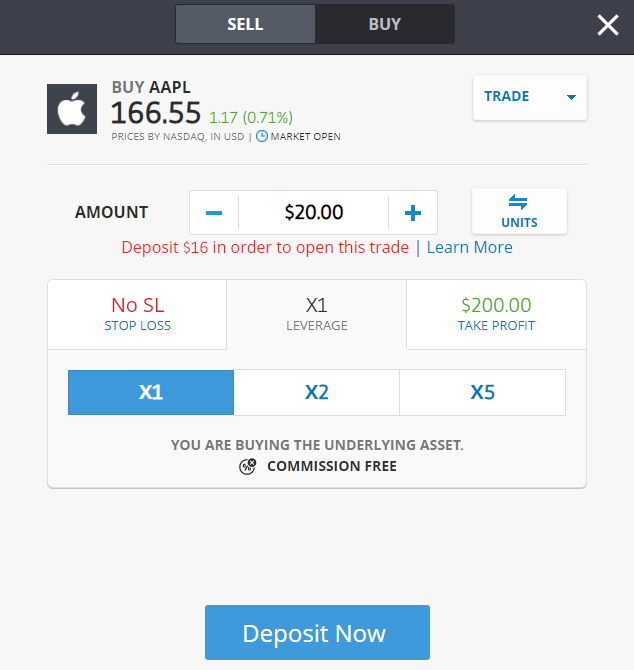

Placing orders

You can use the following order types:

-

Market

-

Limit

-

Stop-loss

-

Trailing stop-loss

We found it quite strange that you cannot edit pending limit orders. For example, if you have a limit order for company X at $20 per share, you must cancel the pending order and create a new one in order to modify the order to $21 per share.

If you are unfamiliar with some of these terms or want to learn more, read our overview of order types.

eToro review - Web trading platform - Order panel

Alerts and notifications

You can set price alerts and notifications on the eToro web trading platform.

eToro's alert function lets you know when an asset reaches a price target, and you also get a notification when your order is fulfilled. On the web platform, this is in the form of an icon update or a browser notification. On mobile, it is a push notification.

Portfolio and fee reports

eToro has clear fee reports.

You will surely want to know how your portfolio is performing and how much you paid in fees. You can decide how you want to see your portfolio reports: a list of your assets or a pie chart showing your current portfolio.

Finding the fee report can be quite complicated when doing it for the first time. Click on the 'Portfolio' tab, then go to 'History', and under the settings icon at the top right, you can access and download your account statement. This is a well-structured pdf file showing all your cash flows, including fees. When you are following someone, you will see all trades separately. However, fees are not added up, but listed individually by fee deduction.

51% of retail CFD accounts lose money

Mobile app

Score: 4.9/5

eToro's mobile platform is well-designed, intuitive and considered safe thanks to the two-step and biometric login functions.

Pros

Two-step (safer) login

Good search function

Touch/Face ID login

Cons

None

The eToro mobile trading platform is available for iOS and Android. We tested it with iOS.

The mobile trading platform is available in several languages.

Look and feel

The mobile trading platform is extremely user-friendly and well-designed.

eToro review - Mobile trading platform

Login and security

eToro provides a safer, two-step login for its mobile platform.

You can log in using biometric authentication, which is a convenient feature.

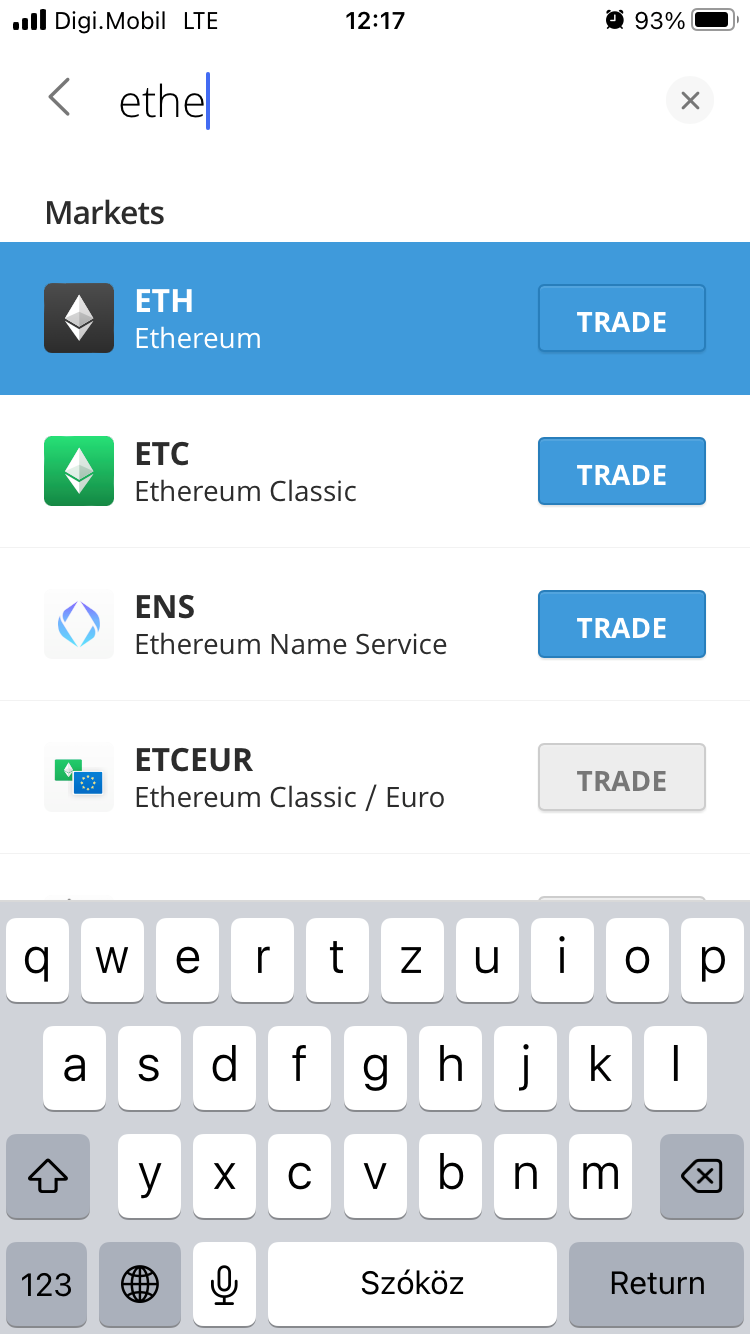

Search functions

The search functions are good.

eToro review - Mobile trading platform - Search

Placing orders

You can use the following order types on the mobile trading platform:

-

Market

-

Limit

-

Stop-loss

-

Trailing stop-loss

Alerts and notifications

You can set alerts and notifications on the eToro mobile platform.

Our analysts personally tested eToro's mobile app, check out their verdict.

51% of retail CFD accounts lose money

FAQ

How does eToro work?

eToro is primarily a CFD and forex broker, but you can also trade real stocks, ETFs and many cryptocurrencies on its platform. It is well-known for its social trading feature, which allows you to follow and copy the portfolio of any trader in the eToro network.

Who owns eToro?

At the time of writing this review, eToro was a privately held company and as such not required to publish its ownership structure. What we know is that eToro does not have any banking parent company (little chance for a bailout in case of bankruptcy). The well-known founder and CEO of eToro is Yoni Assia.

eToro is funded by venture capitalists. Here are a few of them:

-

Anthemis Group, UK

-

BRM Capital, Israel

-

CommerzVentures GmbH, Germany

-

Cubit Investments, Israel

-

MoneyTime Ventures, USA

-

Ping An, China

-

Spark Capital, USA

How does eToro make money?

eToro makes money by collecting various fees and the trading services it provides on its website. Although eToro does not make its financial statements public, the main sources of revenue for eToro are likely:

-

Spreads: Spreads are the gap between the buy and sell price. Put simply, if an Apple stock costs $100 at market price, eToro will charge $100.1 for it and will pocket the $0.1. For further info, read how CFDs work.

-

eToro overnight fee: For this, you need to understand two things: leveraged trades and loans. Leverage means that you trade with more money than you actually have by borrowing funds from your broker. Let's say you want to trade Apple with 1:10 leverage and you have $10. By using leverage you can buy $100 worth of Apple stocks with your 10 bucks, as the missing $90 will be lent to you by eToro, which will charge you a fee (interest) for this loan.

-

Non-trading fees: eToro charges fees for several services, which are not directly related to trading, also known as non-trading fees. Some examples of non-trading fees are:

-

Withdrawal fees ($5/transaction): charged when you withdraw money from your eToro account to your bank account

-

Conversion fees: charged if eToro converts money to fund your account (i.e. you send euros to deposit into your eToro account and the broker converts them to USD, which is the only account currency available at the broker)

-

Can eToro be trusted?

eToro is regulated by CySEC in Cyprus, ASIC in Australia, and the FCA in the UK. This is a good thing. eToro is not listed on any stock exchange, nor does it publish its financial data. Overall, BrokerChooser's view is that while eToro is not a scam, it is not a fully transparent broker either.

How does eToro Copy Trader work?

eToro copy, a.k.a. CopyTrader, is a social trading tool. When you use CopyTrader, you copy the trades of other eToro users or other users copy your trades. You can search for traders in the eToro network and check how their portfolio performed historically. When you find a trader you like, you can copy their trades automatically. You can decide how much money you want to invest in copying another trader, and you can close your positions whenever you wish. You can also make money by having other traders copy you.

Are profits made by trading on eToro taxable?

Any profit realized by trading on eToro can be subject to taxation laws and regulations. This depends on the country of your residence. For further information about eToro and taxes, we recommend you contact your local tax authority.

Can I use eToro in the USA? Can I use eToro in Canada?

Currently, people from the USA cannot use all services and features provided by eToro because US regulations do not allow trading in CFD instruments (eToro is a CFD broker) for US residents. As a result, no regulated broker will allow retail clients in the US to trade CFDs. US clients can trade crypto, real stocks and ETFs on eToro.

eToro is not available to the residents of the following countries:

-

Afghanistan

-

Albania

-

Bahamas

-

Barbados

-

Belarus

-

Bosnia and Herzegovina

-

Botswana

-

Brunei

-

Burundi

-

Cambodia

-

Canada

-

Chad

-

Congo Republic

-

Crimea Region

-

Cuba

-

Democratic Republic of the Congo

-

Ethiopia

-

Fiji

-

Ghana

-

Guinea

-

Guinea-Bissau

-

Guyana

-

Iran

-

Iraq

-

Jamaica

-

Japan

-

Laos

-

Libya

-

Mali

-

Mauritius

-

Mongolia

-

Montenegro

-

Myanmar

-

Namibia

-

Nicaragua

-

North Korea

-

North Macedonia

-

Pakistan

-

Palau

-

Samoa

-

Serbia

-

Somalia

-

Sri Lanka

-

Sudan

-

Syria

-

Trinidad and Tobago

-

Tunisia

-

Turkey

-

Uganda

-

Vanuatu

-

Yemen

-

Zimbabwe

What is the downside of eToro?

At eToro, you can trade CFDs, which are complex instruments and carry a high level of risk. Many retail traders can lose their invested money and may even owe funds if their trade goes wrong. That may happen because trading CFDs involves leverage or borrowing capital. Some 68% of retail investor accounts lose money when trading CFDs with eToro.

Is eToro good for investing?

eToro has its pros and cons: they provide free stock and ETF trading, a seamless account opening process, and a superb social trading platform. We chose eToro as the best social trading broker and the best broker for cryptos. However, their non-trading fees are high.

Is eToro really free?

eToro offers free stock and ETF trading, while forex and CFD fees are low. On the negative side, non-trading fees are high, including a $5 withdrawal fee. The minimum deposit in EEA countries is $50, while it’s $10 in the US and UK.

Is eToro trustworthy?

eToro is a highly regulated broker that is overseen by several top-tier authorities, such as the FCA in the UK, Cysec in Cyprus and ASIC in Australia. Multiple regulation adds a high level of security to eToro. Clients trading with eToro’s FCA and CySec-regulated entities are entitled to investor protection. In addition, eToro provides private insurance to its customers accepted under these three regulators. Client’s cash funds deposited into their eToro account are held in regulated and licensed US banks and are FDIC-insured up to $250,000. Personal data is kept under SSL encryption.

Do you actually own the stock on eToro?

If you trade stock CFDs on eToro, you will not own the underlying stocks. CFDs are clearly marked on eToro’s trading platform. Except for US clients, eToro customers can also trade real stocks (if they select the option to trade without leverage), in which case they will own the stock in question.

How much does eToro charge to withdraw?

eToro charges a $5 fee to withdraw funds from your trading account. As only USD accounts are available at eToro, you will need to pay a high conversion fee if you deposit or withdraw in a currency other than USD.

Is eToro an Israeli company?

eToro is a well-known Israel multinational social trading platform and fintech company, focusing on copy trading and financial services. It has registered offices in the United Kingdom, Australia, the United States and Cyprus. eToro serves UK clients through a unit regulated by the FCA, Australians through an ASIC-regulated entity, and all other customers are served by a legal unit under CySEC supervision. US customers trade with an eToro unit regulated by SEC and FINRA.

How long does it take to withdraw money from eToro?

Withdrawal times at eToro depend on the withdrawal method. For us, a bank withdrawal took 2 business days. Most payment providers, such as e-wallets, take 1-2 business days. A wire transfer typically takes 3-8 business days at most.

What is better than eToro?

Our best alternatives and highest ranking competitors to eToro are:

-

XTB

-

Trading 212

-

IG

-

Markets.com

These brokers are comparable in terms of the products they offer (i.e. stocks, CFDs, crypto, etc.) and the type of clients they target ( i.e. beginners, experienced investors, or day traders).

In the comprehensive collection below, you can find links to all aspects of eToro.

Lower fees, lower costs?

We detailed this in our eToro fees article.

What about the minimum deposit?

Our ultimate guide to the eToro minimum deposit is updated regularly.

How to start your eToro account?

Look no further than our evaluation of the eToro account opening.

How's their trading app?

Here's our expert view after checking the eToro trading app.

Is the quality of customer service satisfactory?

All you need to know about the eToro customer service.

Legit or scam?

Is eToro legit features all the key aspects you need to look at to see if a broker is safe and legit.

Free or premium? Or both?

A glance at actual costs and whether eToro is really free.

Is this broker good for beginners?

We checked it in Is eToro good for beginners.

Should you buy your silver bullets on eToro?

Research for silver bugs in the Silver buy on eToro guide

I want to trade options, are they available at eToro?

We explored the topic in Can you trade options on eToro?

Product selection

Score: 3.9/5

At eToro, you can trade CFDs and forex, as well as real stocks, ETFs, and many cryptos. Innovative services like social trading and Smart Portfolios are also available.

eToro is primarily a CFD and forex broker. However, you can also trade real stocks, ETFs and various cryptos. eToro also has some unique features, such as social trading (CopyTrader) and Smart Portfolios (previously called CopyPortfolios).

If you reside in the United States, you can trade stocks, ETFs, options, and cryptocurrencies.

Real assets vs. CFDs

All non-leveraged long positions in stocks, ETFs and cryptocurrencies are traded as real assets.

This means that when you buy these assets without any leverage (i.e. leverage is set to one), you will buy real stocks, ETFs and cryptos and not CFDs.

All other positions are CFDs:

-

leveraged long positions and all short positions in stocks, ETFs and cryptos

-

all positions of forex, commodities and indices

eToro vs. traditional stockbrokers

So, does that mean that eToro acts like a traditional stockbroker just with zero commission when you buy stocks? The answer is no, there are some differences.

For example, it is not possible to initiate a stock transfer between eToro and another brokerage (or vice versa). This means that all positions that are opened with eToro must be closed with eToro.

eToro customers holding a ‘real’ US stock position (where they are investing in the underlying asset) are eligible to participate in the company's shareholders' meeting and vote. However, owners of fractional shares won’t have voting rights.

When there is a company meeting, eToro arranges electronic proxy voting. This means that when shareholder actions are required, eToro sends an email to the eligible customers with information on the upcoming vote, including the items to be voted on, the voting deadline, the link to join the meeting virtually, and the voting website.

We do not recommend eToro for long-term investors focusing on collecting dividends from US stocks. This is because eToro deducts the 30% default US dividend tax, rather than the – usually lower – tax treaty rate deducted by most other brokers. Instead, we suggest you check out the best discount brokers.

All of the above seem to suggest that while eToro is great for stock traders, for long-term investors it might not be the best choice. We're not sure how eToro would handle corporate events (e.g. a spin-off).

CFDs

Let's pivot to eToro's CFD offering. Within CFDs, in addition to the traditional way of trading, you can

-

follow and copy other traders' trading (this is CopyTrader, also called social trading)

-

invest in a compiled portfolio (this is Smart Portfolios)

To learn more about CFDs, read our CFD trading tips.

Note that scalping is not allowed at eToro.

eToro product selection

Products | eToro | Trading 212 | XTB |

|---|---|---|---|

Currency pairs (#) | 52 | 180 | 70 |

Stock index CFDs (#) | 20 | 35 | 33 |

Stock CFDs (#) | 2,000 | 1,530 | 2,022 |

ETF CFDs (#) | 264 | 28 | 167 |

Commodity CFDs (#) | 32 | 28 | 27 |

Bond CFDs (#) | - | - | - |

Cryptos (#) | 74 | - | 40 |

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Leverage

You can change the default leverage of the products.

Changing the leverage manually is a very useful feature when you want to lower the risk of a trade. For example, instead of trading with 5:1 leverage, trading with only 2:1 leverage in the case of stock CFDs reduces your risk exposure significantly. Be careful with forex and CFD trading, since the pre-set leverage levels are high.

Real stocks and ETFs

If you buy stocks or ETFs without leverage, you are buying the real asset, not a CFD. Usually, this feature is not offered by other CFD and forex brokers.

Note that if you're going short (selling a stock that you don't already have), you're always trading a CFD.

eToro stock and ETF selection

Broker | Stock markets (#) | ETFs (#) |

|---|---|---|

eToro | 17 | 420 |

Trading 212 | 15 | 1,800 |

XTB | 17 | 366 |

At eToro, you have access to the following stock exchanges:

-

Amsterdam

-

NYSE

-

Nasdaq

-

Euronext Brussels

-

Euronext Lisbon

-

Frankfurt

-

London

-

Paris

-

Madrid

-

Milan

-

Zurich

-

Oslo

-

Stockholm

-

Copenhagen

-

Helsinki

-

Hong Kong

-

Saudi Arabia

However, you can only trade the more popular stocks. For example, the number of tradable stocks on the Nasdaq with eToro is currently less than 700, which is only around 20% of the listed companies on the Nasdaq exchange.

Why would this matter to you? If you only trade the most popular stocks, like Microsoft or Apple, you probably won't notice the lack of smaller stocks. eToro will, from time to time, make new stocks available for trading, usually in a batch.

For example, eToro added 185 new stocks on March 30 2020 in the beginning of the Covid pandemic, among them a very trending one called Zoom Technologies. However, if you had to wait for eToro to add the stock, you missed the early rally in the stock.

Interest on uninvested cash

eToro pays up to 5.3% interest on uninvested USD. The rate that you will receive is determined by your total balance. The total balance required includes your investments and your cash balance but the interest will only apply to your available cash balance.

As of August 23, 2024 the following rates apply:

Total balance required | $250,000 | $50,000 | $25,000 | $10,000 |

Annual interest rate | 5.3% | 5% | 4% | 2% |

You will need to activate eToro’s interest on balance for your account by switching the “Interest on Balance,” from “Disabled” to “Active". If you have enough balance, the broker will pay the interest to your account each month.

eToro has two distinctive innovations, CopyTrader and Smart Portfolios.

CopyTrader

CopyTrader is the so-called social trading feature. What is eToro really good at? Well, this is it! One by one you can copy the portfolio of traders who also trade on eToro. This might be of interest for those who don't want to manage their own money. You can browse through the profiles of other eToro traders, checking their previous performance on an annual and a monthly level. Their portfolio is public information.

Additionally, eToro also applies a risk score to each trader. There are tons of additional stats for each profile, like trades per week, average holding time, performance on charts, and you can also see their detailed profiles as well as their news feed comments. Imagine Facebook profiles, but with fewer inspirational and more market quotes.

The minimum amount you can invest in one trade is $200. While there is no extra fee for this service, spreads and overnight fees may be applied according to each opened copied position.

Disclaimer: Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorized and regulated by the Cyprus Securities and Exchange Commission.

Smart Portfolios

Previously called CopyPortfolios, Smart Portfolios are a grouping of several assets, such as stocks, cryptocurrencies, ETFs, and even people, bundled together based on a predetermined theme or strategy.

-

Investing in themes means, for example, investing in a portfolio of Future Payment systems, DroneTech, Renewable energy or cryptocurrencies. The Crypto Portfolio, for instance, consists of the biggest cryptocurrencies, weighted by market cap.

-

Another way to invest via Smart Portfolios is to invest in a portfolio comprised of multiple "star" traders.

Disclaimer: Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

The proportion of CFDs in the specific Smart Portfolio is clearly indicated. You can check performance and asset distribution, and read the investment strategy. Smart Portfolios are built around a theme by eToro's algorithms (using machine learning and data science) or by eToro external partners.

This might all sound a bit complicated, but at the end of the day, this means you can invest easily in a quasi-fund. The minimum amount required to invest in Thematic Market and Partner Portfolios is $500, while for Top Trader Portfolios, the minimum is $5,000. eToro also checks your financial knowledge to determine whether Smart Portfolios is right for you.

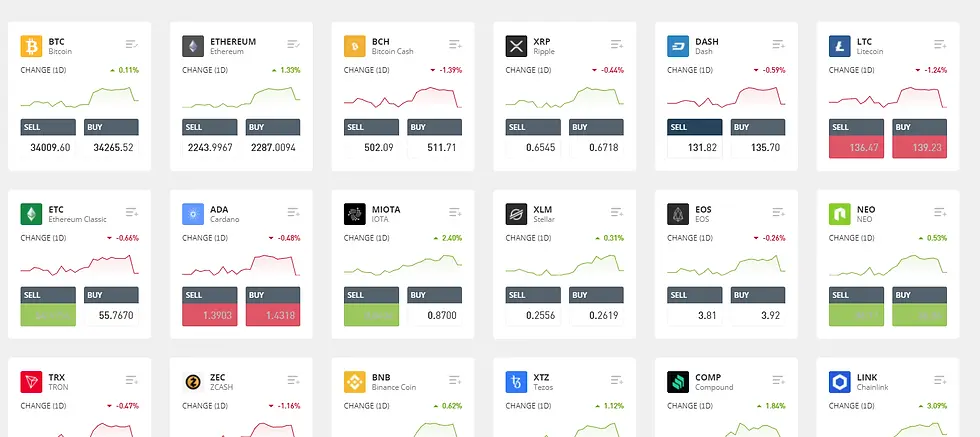

Cryptocurrency

Not only does eToro offer 74 different coins to trade, but you also have the option to trade 14 crypto crosses (like ETH/BTC) and 63 non-USD currency crosses (like LTC/AUD).

eToro offers the following methods to trade and own cryptocurrencies: Crypto CFDs, Spot crypto and Crypto wallet.

However, not every method is available in every country. For example, UK residents don't have access to Crypto CFDs.

The general rule of thumb with eToro is that when you go long in any virtual currency, you will own the real coin. When you go short, it is a CFD.

However, there are some country-specific rules as discussed above. For example, as a US resident, you can only go long on the real coin; trading CFDs and therefore going short on cryptocurrencies is not allowed.

Cryptocurrency prices can fluctuate widely and are therefore not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework, such as MiFID. Therefore, when using eToro's Cryptocurrencies Trading Service you are not eligible for any investor protection.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more!

You can trade a wide variety of cryptocurrencies on eToro. Along with STORJ, BAL, GALA and LRC, traders have access to BTC, ETH, BCH, LTC, XRP, DASH, ETC, ADA, XLM, EOS, NEO, TRON, ZEC, BNB, XTZ, MIOTA, LINK, UNI and DOGE. Check the table below for a detailed breakdown and some other minor virtual currencies.

See also our detailed guide on how to buy Bitcoin on eToro.

eToro cryptocurrency selection

Cryptos as real assets (for non-US residents) | Cryptos as CFDs (for non-US residents) | Cryptos as real assets (for US residents) |

|---|---|---|

AAVE | ADA | AAVE |

ADA | BCH | ADA |

ALGO | BNB | ALGO |

BAL | BTC | BAT |

BAT | DASH | BCH |

BCH | DOGE | BTC |

BNB | COMP | |

BTC | ETC | DASH |

COMP | ||

DASH | ETH | DOGE |

DOGE | LINK | EOS |

EOS | LTC | ETC |

ETC | MIOTA | Ethereum |

ETH | NEO | LINK |

GALA | ||

LINK | TRX | LTC |

LRC | ||

LTC | UNI | MANA |

MANA | XLM | MATIC |

MATIC | XRP | MIOTA |

MIOTA | XTZ | NEO |

NEO | ZEC | TRX |

STORJ | ||

TRX | UNI | |

UNI | XLM | |

XLM | XTZ | |

XRP | YFI | |

XTZ | ZEC | |

YFI | ||

ZEC |

To dig deeper, read eToro's CFD description. We would also recommend reading our article on how to invest in Bitcoin.

Disclaimer: This material has been translated, and its content may not be suitable for every recipient. Additionally, certain products may be restricted in your region.